Key Takeaways

Is XRP’s chart signaling a deeper decline toward $2.72?

The descending triangle pattern, reinforced by dominant sell-side CVD, indicates sustained downward pressure that could drive a retest of $2.72.

Can weakening on-chain and derivatives activity affect XRP’s stability?

Falling Open Interest and lower network participation show fading confidence, which could increase the likelihood of another downward move.

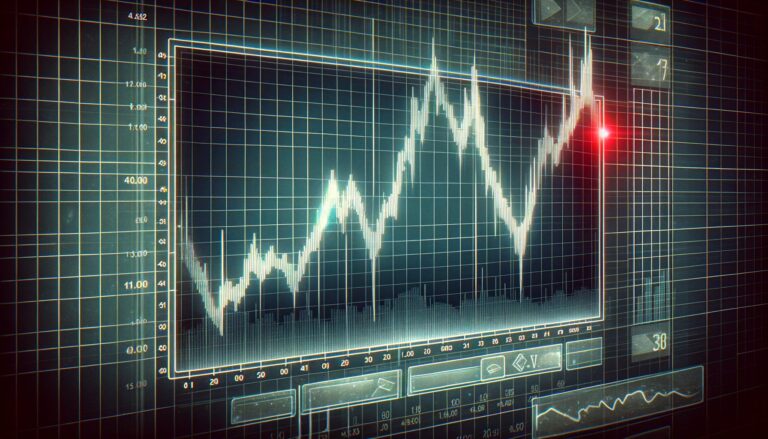

Ripple [XRP] has been showing visible weakness within a descending triangle, with lower highs compressing against a flat support near $2.72.

Bearish pressure is building across the market, with sell-side momentum on the rise. On-chain and derivatives data show traders are losing confidence, and overall sentiment remains cautious.

For XRP, several key indicators now signal a shift toward downward momentum. The spotlight is on the $2.72 support level.

Can it hold, or will fresh selling pressure drive prices into a deeper decline?

Spot taker CVD signals persistent sell pressure

The Spot Taker CVD remains in “Taker Sell Dominant” territory, implying continuous net selling in the spot market. This trend indicates that aggressive market participants are still offloading XRP, limiting any meaningful bullish recovery.

Additionally, short-term bounces have failed to reverse this pattern, showing that sellers maintain control of momentum. However, if this selling intensity eases, XRP could stabilize briefly before its next major move.

Market conditions remain fragile, and any further downside push could easily drive a retest of the triangle’s lower boundary near $2.72.

Source: CryptoQuant

On-chain activity weakens!

On-chain data shows a significant cooldown in network participation, reflecting waning investor enthusiasm.

Transaction count recently dropped to around 109K, while network growth fell to just 859 — both signaling a steep decline in on-chain activity.

This slowdown suggests that fewer addresses are engaging with the XRP Ledger, reducing transaction volume and overall network momentum.

However, a rebound in network engagement could indicate renewed accumulation.

Until then, the fading activity reinforces the bearish narrative already reflected in XRP’s technical setup and trading volumes.

Source: Santiment

Falling Open Interest shows…

Open Interest (OI) declined by 6.51% to 2.78 billion, at press time, underscoring lower participation among derivatives traders. This drop shows that both long and short traders are closing positions as volatility subsides.

Such contraction often precedes a continuation of the prevailing trend, especially when accompanied by dominant sell-side pressure.

However, low leverage exposure might limit the extent of forced liquidations in the short term.

For XRP to regain momentum, new positions must emerge with renewed confidence. Until that happens, the prevailing caution could support another retest toward $2.72.

Source: CryptoQuant

Will XRP truly fall to $2.72 or hold the line?

XRP faces a decisive moment as multiple indicators align toward downside pressure. Technical weakness, shrinking network activity, and declining OI all suggest limited bullish support.

While $2.72 remains a key psychological and structural level, sustained sell dominance could drive a deeper retracement.

Unless demand strengthens soon, XRP’s short-term outlook leans bearish, increasing the probability of a retest at $2.72 before any potential rebound.