Key Takeaways

Why is BlackRock leading ETF outflows?

Per Hayes, hedge funds are liquidating their BTC positions as the basis trade declines.

What’s the pivot he sees for the market?

According to him, an improvement in the liquidity conditions in early December could juice risk assets and drive BTC to $200k.

Bitcoin’s [BTC] institutional flows have remained negative for the fourth week in a row, further accelerating the ongoing sell-off.

So far in November, $2.59 billion has left the U.S. spot BTC ETFs, with half of the outflows ($1.26 billion) driven by BlackRock’s IBIT investors.

What’s next for BTC as hedge funds exit

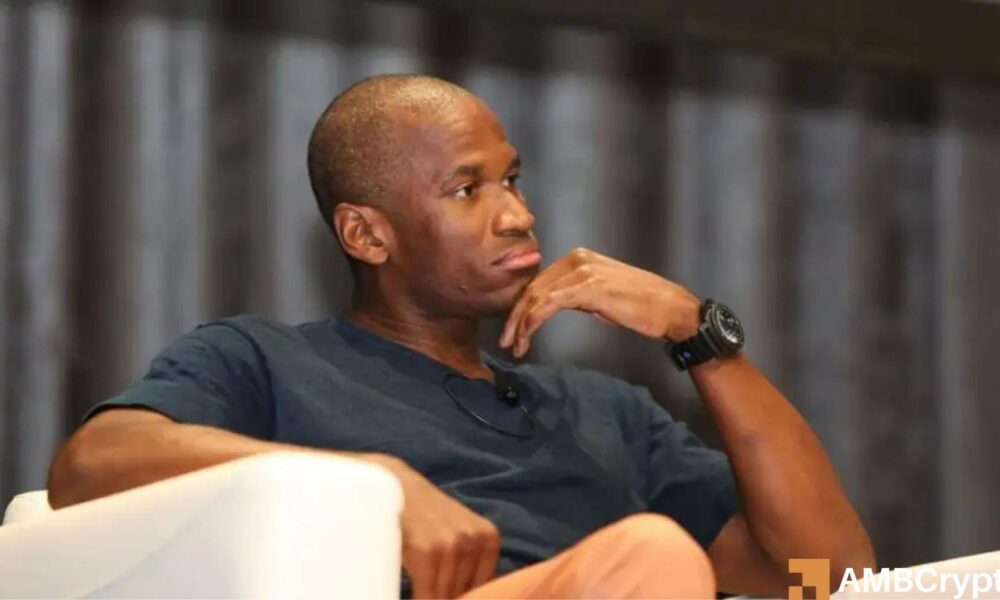

According to Arthur Hayes, founder of BitMEX, the BlackRock bleed-out was primarily from hedge funds, such as Goldman Sachs, which have been seeking extra yield above Fed rates via BTC basis trade.

It involves buying spot BTC ETFs and shorting on the asset on CME to capture the spread (basis trade).

However, now that the basis trade is no longer attractive, they have hedge funds with spot BTC ETFs that have exited their positions, noted Hayes.

Since October, the yield has shrunk from about 14% to below 5%. And with it, the hedge fund-led ETF outflows intensified, further spooking retail investors, added Hayes.

“Now retail believes these same investors don’t like Bitcoin and creates a negative feedback loop that influences them to sell, which decreases the basis, finally causing more institutional investors to sell the ETF.”

Treasury demand and liquidity shifts

Additionally, the demand from BTC treasuries has also faded, further reinforcing the short-term concern that major players are taking a wait-and-see approach.

Hayes highlighted that the dollar liquidity has also been withdrawn and could be re-injected by December when the Fed ends Quantitative Tightening (QT).

The Treasury General Balance (TGA) is the U.S government’s primary operating account and directly affects market liquidity.

A TGA balance increase leads to liquidity drains as the Treasury collects more money from the market, while a decrease boosts liquidity.

According to the chart shared by Hayes, there was an uptick in TGA in late October that further deepened the market rout, particularly for risk assets.

Hayes projected that BTC could slip toward $80k–$85k in the short term before surging toward $200k by year-end, contingent on liquidity easing.

In the meantime, Hayes expected the privacy narrative, led by Zcash [ZEC], to remain strong despite broader weakening. In fact, he dumped most of the altcoins for ZEC.